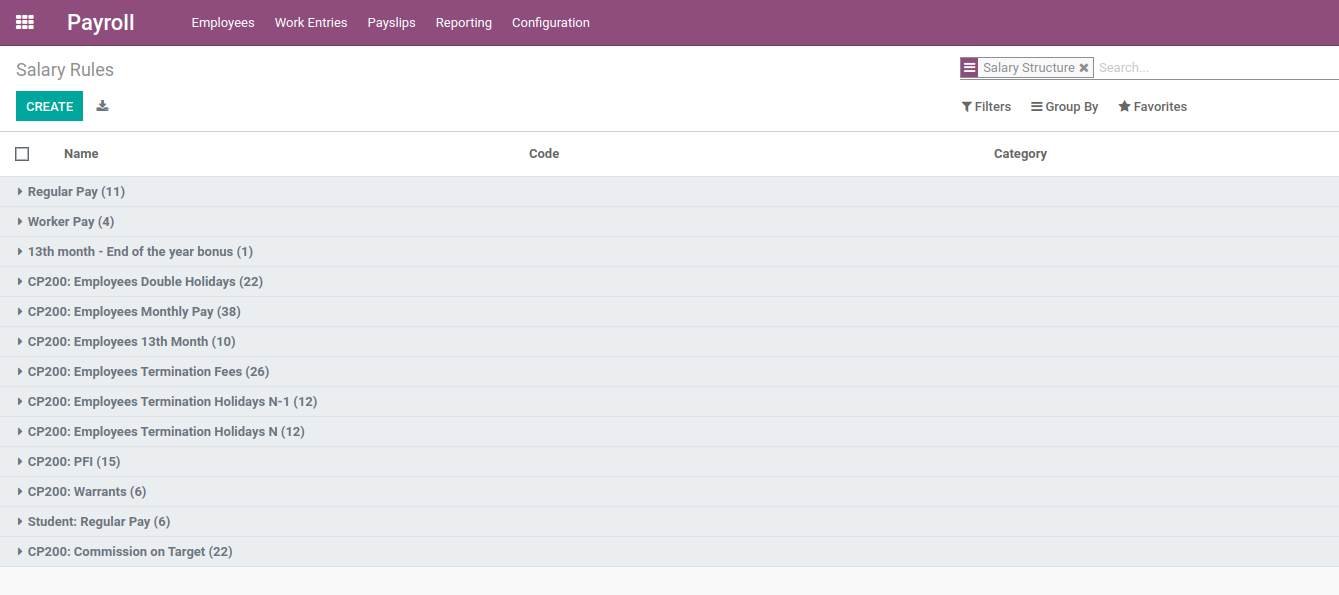

AUTOMATE SALARY STRUCTURES

No Excel Sheets. No Manual Formulas.

Odoo Payroll lets you define salary rules, allowances, and deductions based on roles, contracts, and performance—all fully automated.

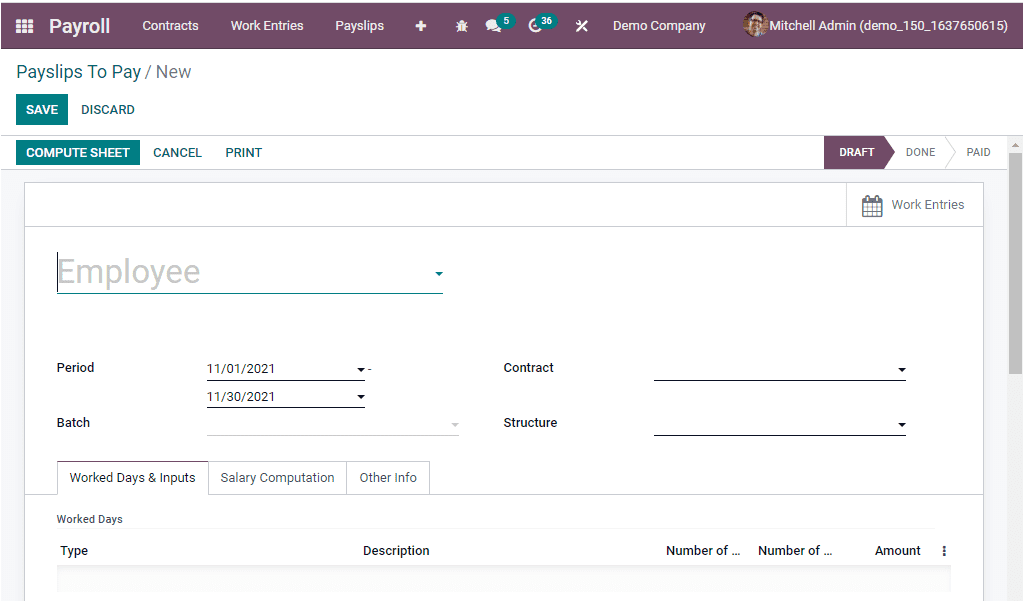

GENERATE PAYSLIPS INSTANTLY

No Delays. No Compliance Errors.

With just a few clicks, generate accurate payslips reflecting work hours, benefits, and taxes—auto-calculated from integrated HR data.

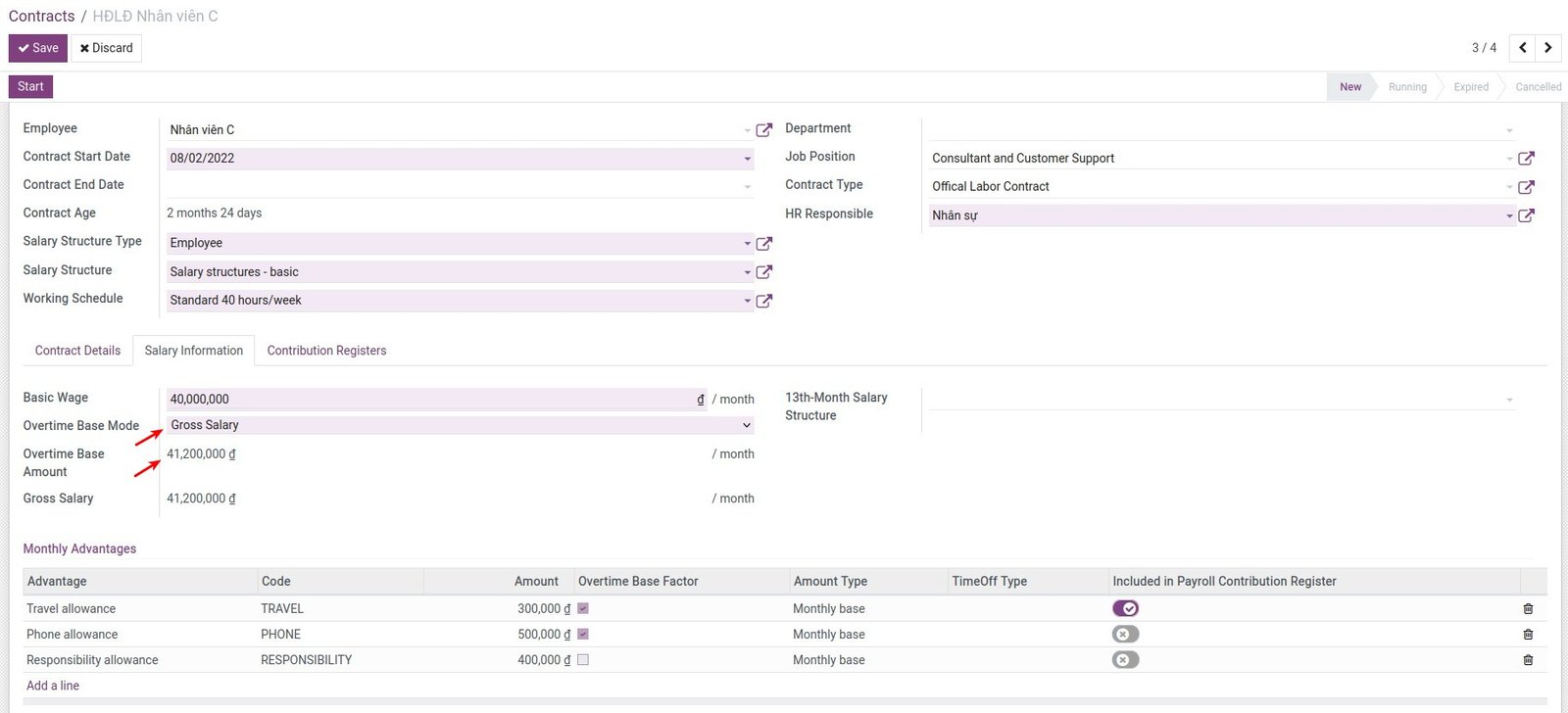

HANDLE OVERTIME & DEDUCTIONS

No Calculation Mistakes. No Double Work.

Overtime, loans, fines, or bonuses—everything is auto-applied to payroll using dynamic rules tied to employee records and attendance logs.

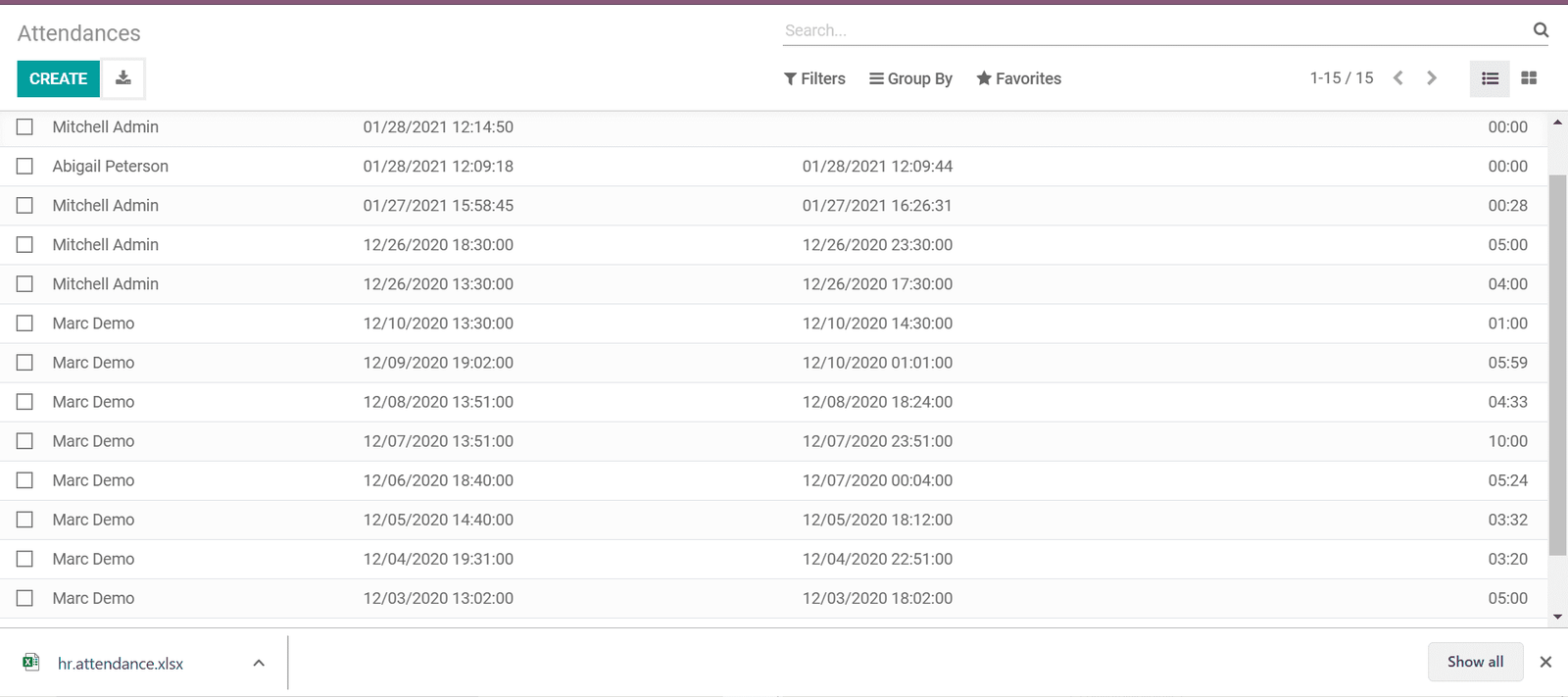

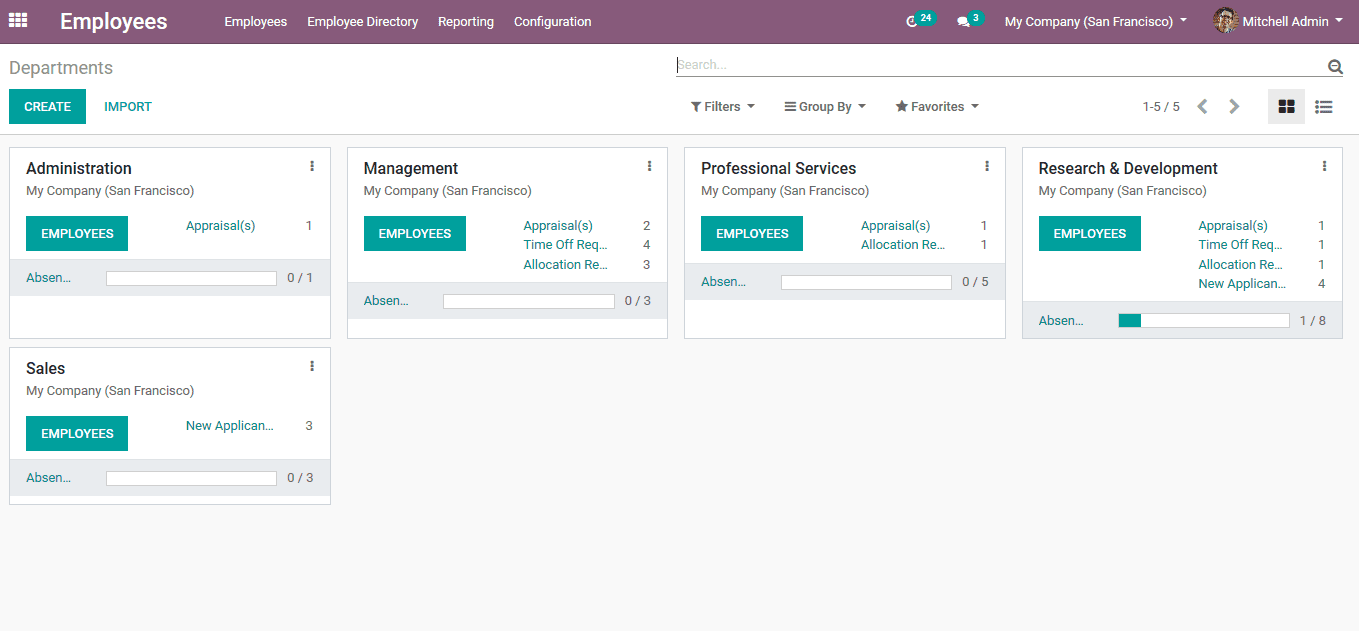

INTEGRATE LEAVE & ATTENDANCE

No Separate Systems. No Data Gaps.

Odoo Payroll syncs with time-off and attendance records, ensuring every paid hour or deduction is precisely reflected in monthly payroll.

MANAGE GRATUITY & FINAL SETTLEMENTS

No Paperwork. No Manual Reports.

Automate end-of-service calculations including gratuity, notice periods, and remaining leaves—all handled smoothly during offboarding.

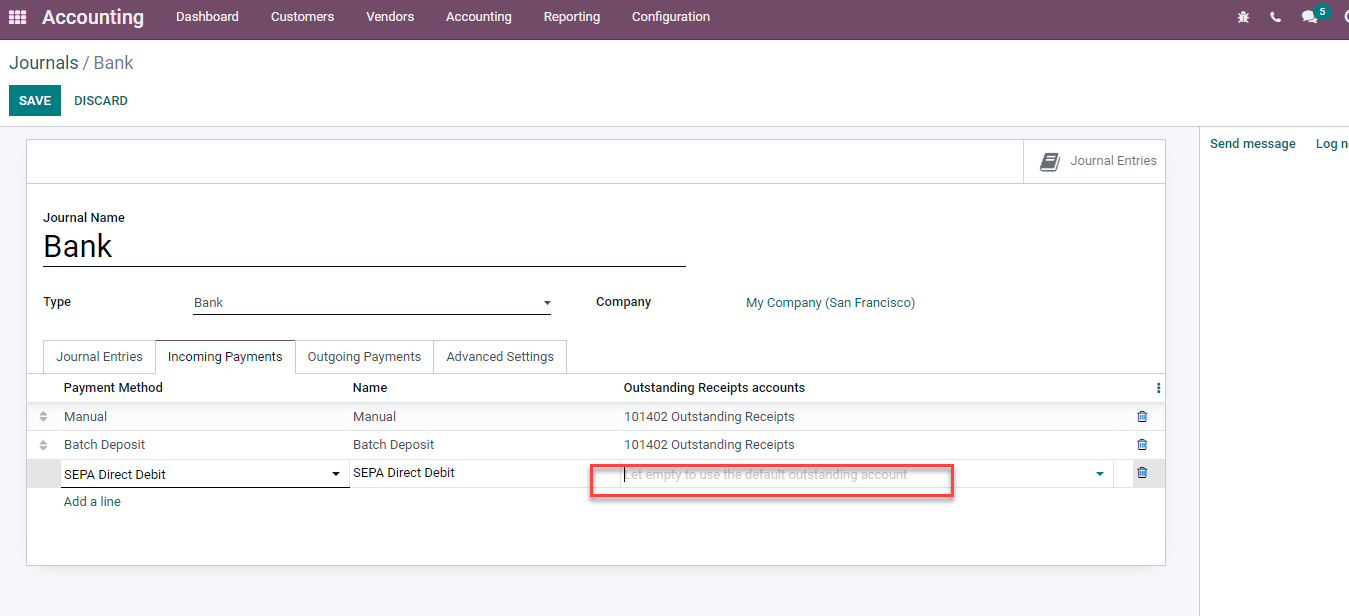

EXECUTE BANK PAYMENTS EASILY

No Errors. No Upload Hassles.

Generate WPS-compatible bank files and bulk salary transfers with a single click. Odoo Payroll supports secure, compliant payment flows.

- Frequently Asked Questions (FAQs)

What payroll features does Odoo offer?

Odoo covers complete payroll processing including payslips, salary rules, overtime, WPS files, gratuity, and automated leave integration.

Can payroll be linked to attendance?

Yes. Odoo automatically pulls real-time attendance data to ensure payroll is always accurate and aligned with work hours.

Is Odoo Payroll compliant with UAE WPS?

Absolutely. Odoo can generate SIF files and meet WPS standards for salary disbursements in the UAE, ensuring regulatory compliance.